What some people don’t realize is that they have several credit points, not just one. At present, there are more than 100 credit scoring models sold to the borrower, the most common one is FICO, which is used to predict whether the borrower violates the contract. New information is always added to the report and old information is deleted. These constant changes will affect your score.

This credit scoring program performs the following operations:

Detection of fraud in credit or insurance claims

Calculate the profit of the credit card issuer from a specific amount

Anticipate consumer default risk

Predict the possibility of the policyholder using the insurance company’s funds

It is presumed that the borrower can pay the amount from all accounts in arrears

Customer forecast can close credit card account or pay balance with 0

Predict the possibility of someone responding to the direct credit card invitation

Compared with other types of credit scores, lenders are most likely to make decisions based on FICO scores or NextGen scores. FICO is the industry leader using FICO, with about 75% of mortgage loan evaluation.

With this in mind, if you don’t get good grades, you don’t have to be tied here. On the other hand, if we have achieved good results, we should maintain and monitor them.

The most important factor

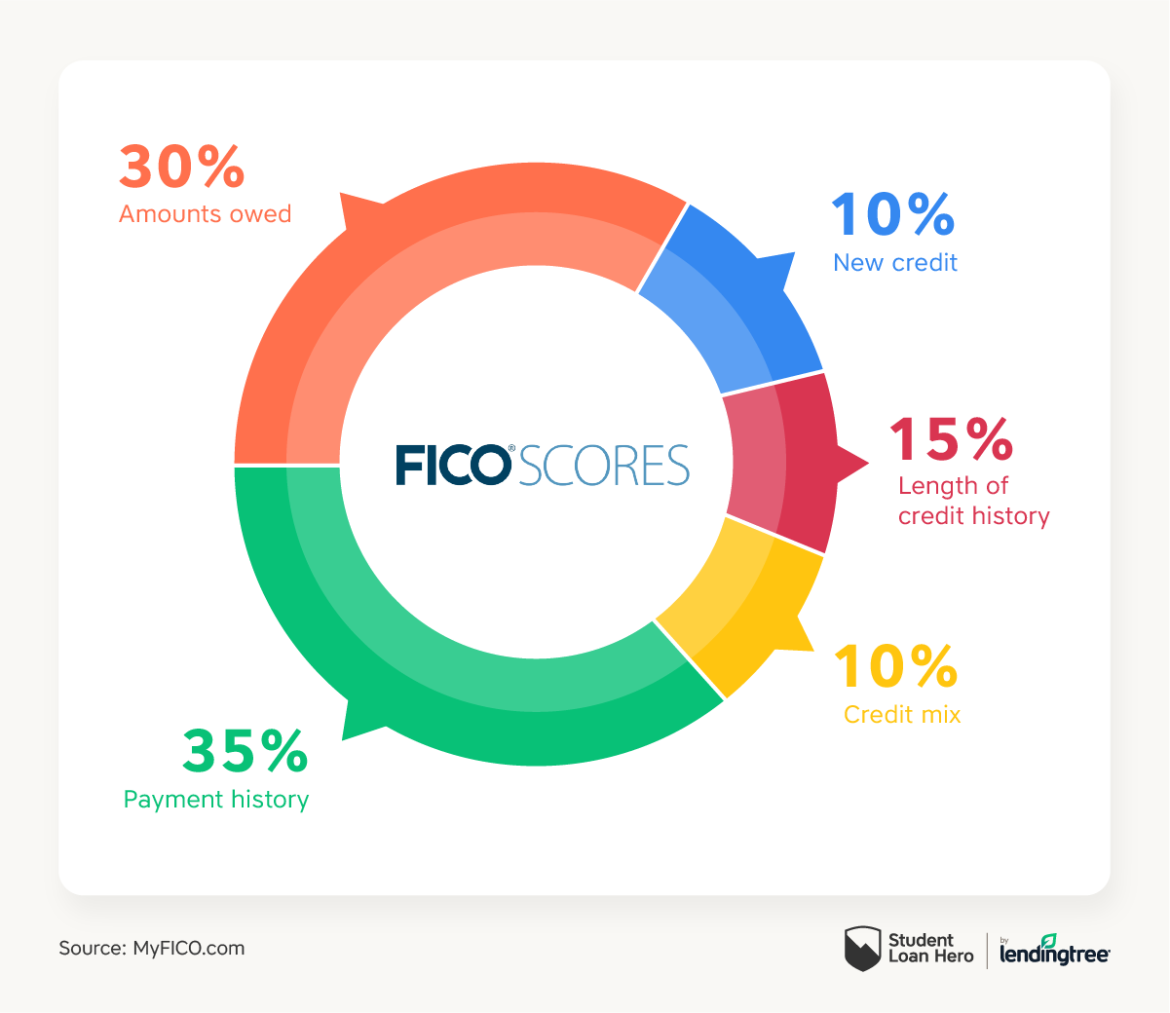

Payment details – about 35% of the points. Because this is your record of paying the bill, it shows your sense of responsibility. The borrower hereby confirms whether you have paid on time, or whether you have paid overdue. If your records do have payment arrears, three factors play a role; 1) Recently — how late have you paid recently? The longer the problem occurs, the smaller the impact on the score. 2) Only those who pay several pieces in arrears can be more easily accepted than those who pay several pieces. 3) Severity – The 30 day overpayment is as serious as the 60 day overpayment.

How much money do you owe? That’s about 30% of your score. It takes into account the total liabilities of all your accounts and the amount of your liabilities in various types of credit accounts (credit cards, car loans, mortgages, etc.). The use of a high rate of credit limit will make the borrower hesitate and affect the score. People with the largest credit card quota are more likely to default than those without credit card quota. The greater the gap between your balance and your limits, the better. The borrower usually reports the balance to the credit bureau once a month (sometimes once a month or quarterly). If you settle the balance the day after they report the balance, the balance will still appear in your report before they report the latest balance next time, so be careful about the fees you charge and the monthly balance. Finally, the score also observed how much the installment loan remained compared to the original loan.

How much credit? About 15% of the score. Although it may be less than other factors before, it is still important. You can have a good credit score, but the credit history is very short, but the longer the time, the better. The score takes into account the age of the oldest account and the average age of all accounts.

Finally, please apply for credits. About 10% of the score. Opening a new account can reduce your score. In particular, it has applied for multiple credit accounts in a short period of time, and the history is not long. “You may have heard” Shopping around “; credit rating will affect scores, but FICO scores consider that people tend to do this for mortgage loans and auto financing. Your own credit report and scores cannot affect your scores. As long as you do it yourself, it cannot be bad for you.

The type of credit you use – the last 10% of your score FICO scoring system likes to see all types of credit. This does not mean that all types of loans are needed in order to achieve good results. Therefore, do not think you need a loan to improve your score, but apply for a loan. Because it will make you uncomfortable. To get high scores, you must have revolving credit lines (i.e. credit cards) and installment loans (i.e. auto loans and mortgages). The credit card through the bank is more suitable for your credit score than ordinary department stores or other “credit cards”; The installment loan is good, because the borrower usually needs more documents about your financial history before making a loan.