We all like to dream about the future we want, but many of us don’t like the idea of organizing finance and making financial plans. Our dreams about the future seem to be an interesting part, but planning sounds like a boring thing. This can be seen from the fact that 65% of individuals have no financial plan.

One study found that financial planning was beneficial. On average, people with retirement plans have 2.5 times more retirement assets than people without retirement plans. Planning is only part of the success equation. The reason for working with consultants and making financial plans is that although they do not work with consultants, their assets are 9 to 10 times more than those with financial plans.

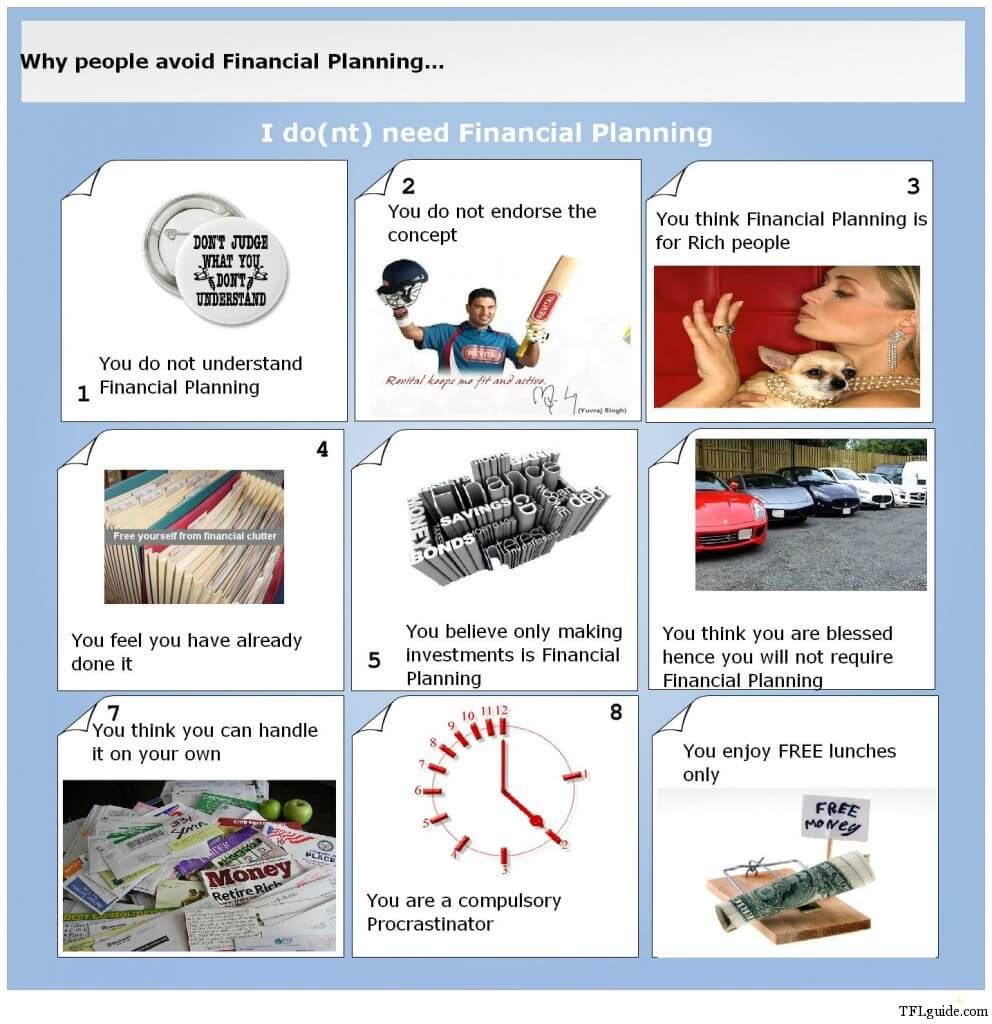

This can explain why one third of people believe that winning the lottery is one of their financial strategies to achieve their financial goals. So why don’t most of us have a plan? This cannot be because many financial institutions lack awareness of the importance of publicity plans. Google also has a large amount of information and materials on the subject, with millions of search results. So, when it comes to financial planning, why are we not ready? The following is a list of the three myths that people I have experienced say.

The Myth of Time: In today’s fast-paced life, we all desire time. We think we are busy with activities every day and have no time to make plans. When it is related to the plan, the time should be agreed in advance when deciding on life goals and taking actions to achieve them, but once these steps are completed, it is only necessary to monitor the progress over time. Work with consultants and make plans according to the above instructions, and the time commitment is the least than the reward.

Knowledge error: The financial world, especially today, seems too complex. All the information is there. We are exposed to a lot of information and financial terminology. If you tell yourself that it is not complicated or difficult at the beginning, there is no reason not to do it. Consider attending a seminar or workshop. You can start reading a book on financial issues. Once you have learned some basic knowledge, you will soon find that the financial world is not complicated.

Fortune Myth: I don’t have enough savings to worry about my financial plans. “If you have savings, you will be enough.” Making a plan not only helps you decide where to put your money, but also helps you decide why. I understand why it is more important than where. When it comes to planning, you should start somewhere. Don’t think that if you don’t feel enough, you shouldn’t have plans. A financial plan will help you identify your goals and dreams to achieve.