Before the era of Internet and rapid communication in the past, when banks and authorities had absolute control over banking services, they could not be managed without banks. Later, a bank cartel was formed, and the commissions for various services they provided were very high. Although some service competitions previously dominated by banks have become increasingly fierce, they continue today. From the simple operation that everyone does on their own account to the credit transfer that people want to do between other accounts.

In recent decades, due to the huge technological development in the computing field, especially the Internet, especially satellite and optical fiber communications, many transactions were completed in a simple, simple and convenient way in the past due to the lack of these means.

In recent years, one of the sectors that have accelerated development is the general transfer of funds, especially the credit transfer conducted by private companies. Compared with banks, the biggest advantage provided by these companies is that the commission is far lower than the bank requirements, and it can also save the long waiting time for queuing services.

In principle, due to concerns about fraud and impersonation, people have natural and understandable concerns about transactions through the Internet. However, in order to ensure safe online use, several effective mechanisms have been established.

In order to check the legitimacy of the website and whether it is an official website, and get the approval of the authorities, it must include the approval signature and confirmation number of the authorities supervising the economic and financial fields.

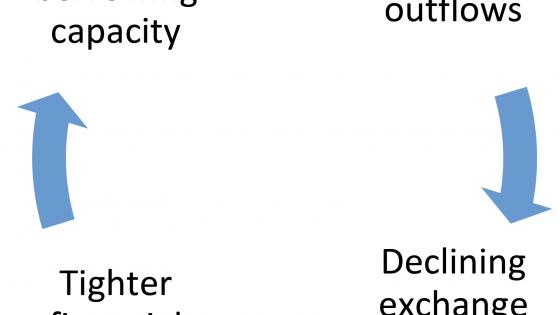

The purpose and function of the agency is to ensure that all activities carried out by the agency are legal and subject to the supervision and management of various agencies.

The field of regulation was first developed as a system management method in the United States at the end of last century. The management organization was initially established because the slide track owner has huge authority and monopoly position on major customers. They are farmers who need services to deliver their products to the central market. In the 1880s, an organized political movement was established, in which farmers played a central role. Various countries of the United States federal promulgated laws and established supervision agencies. The main function of these agencies is to monitor freight. In 1887, the law was extended from the state level to the federal level. The Daytime Standing Committee was established and given the official authority to manage freight.

In the era of the New Deal, the actions of supervisors have been extended to labor and capital markets, electricity, food, medicine, communications and other industries.

In the 1960s and 1970s, more regulatory agencies were established. These agencies were named as part of social regulation, focusing on the development of institutions and regulatory tools for product safety, quality, environmental pollution and workplace safety.

Different from the United States, Britain ignored the tradition of liberalism, and had not formed a formal tradition of restriction until the late 1970s. Contrary to this, the privatization and liberalization process promoted by the Conservative government led by Margaret Thatcher, people, especially telecommunications, cable, natural gas, radio, electricity, water In other words, regulatory authorities should be set up in infrastructure sectors such as fuel and banking, insurance and capital market sectors.

The Financial Supervisory Authority (FSA) monitors all financial factors in England.

Please check the approval of the regulatory authority and the confirmation number that must be displayed on the company’s website to verify the legitimacy of the company you want to cooperate with.