Find them before the IRS finds you.

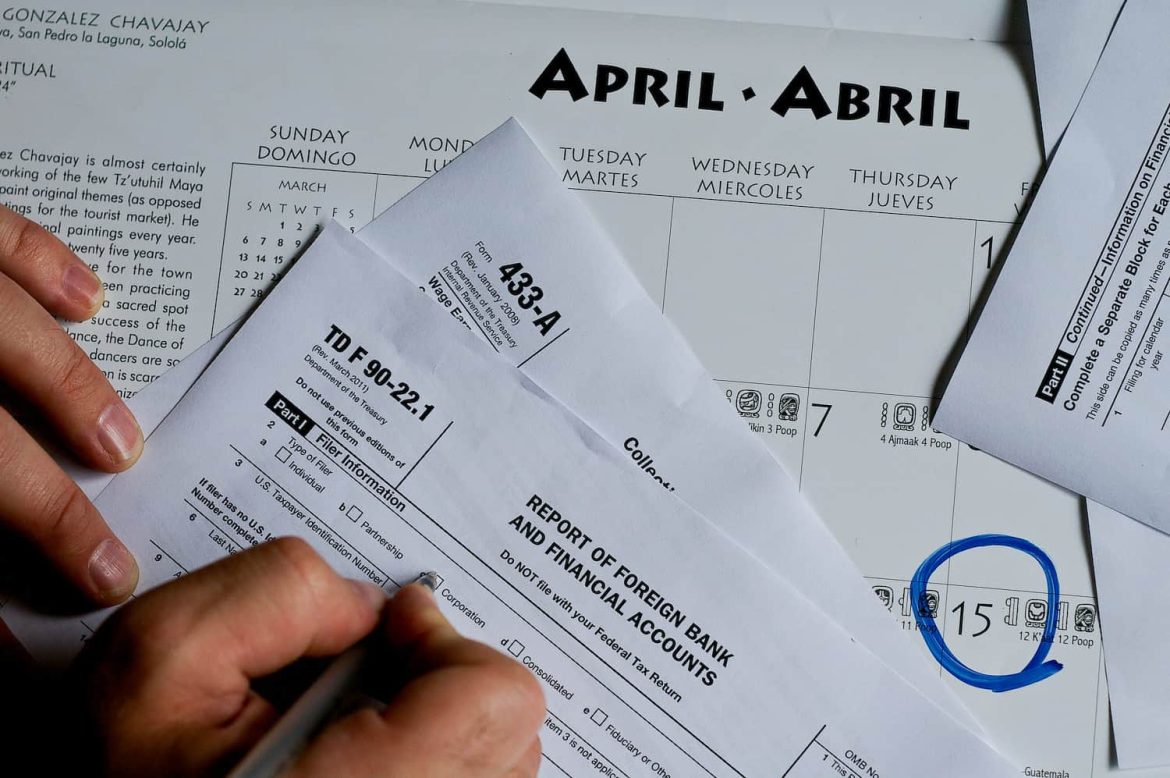

This is the last season for American expatriates to file tax returns with the US Tax Office. The new law will disclose your identity, location and foreign accounts to the US government. Now is the last chance for Americans living abroad to know about your tax returns in the United States. With the coming of the new U.S. FATCA law (“Compliance with Foreign Account Tax Regulations”), your local foreign bank will now be required to disclose your personal information to the U.S. government. This seems not enough. In addition, foreign governments where Americans live overseas will do the same. Collect personal financial data from banks in their countries, and submit it to the US government, so that the US Internal Revenue Service can find you and your assets. These FATCA reporting laws and related enforcement took effect on January 1, 2014.

FATCA-195 countries-1 IRS

With the implementation of these new tasks, there are only two possible ways for American nationals to report to the IRS or disclose foreign assets in the IRS to make them liquid assets. Or the United States will handle it for you. How did the United States do it? The IRS will complete the assessment of what you think should be owed (their assessment is very high) and show you the bill. Whether it is voluntary application or waiting for information from the IRS, the difference in results is surprising.

Amen and Hallelujah – The IRS created a safe and reliable path for American nationals

In addition to formulating and implementing the new FATCA law, the IRS also set out to create a fair way for non tax paying Americans to return home quietly from the side door. They give you the last chance to find them before you find them. This is certain by 2014. It will be found

Doug Shelman, the head of the Internal Revenue Service, said directly to American nationals. We have published a series of common sense measures to help overseas American citizens fulfill their tax obligations in a timely manner; Director Shulman said: “The IRS knows that some American taxpayers living in foreign countries have failed to submit the U.S. federal income tax return or foreign bank and financial account (FBAR) report in a timely manner. Some of these taxpayers have recently become aware of their reporting obligations and are currently exploring compliance with the law.

The statement of Shelman, the director of the Internal Revenue Service of the United States, acknowledged that because he did not know his tax obligations in the United States, almost no Americans who paid taxes or did not make up taxes with unqualified Americans would not be subject to improper review or destructive FBAR (foreign bank account report) punishment.

Under the leadership of Director Shelman, the US Internal Revenue Service (IRS) announced that for US foreign tax filers who have defaulted on most of their taxes, it is sufficient to make up three years’ tax payment. For those who do not know the reporting requirements, the overdue FBAR will not be punished.

FATCA and IRS – waiting person

It is almost always in your personal interest to know your US tax returns. On the contrary, the first person to be discovered by the IRS is always in a worse financial situation. First, a person must deal with the initial evaluation he has received. Another problem is to submit all the tax return forms that the IRS requires you to submit. The earliest date can be traced back to 10 years ago. The opportunity to apply for exemption from foreign income tax may be denied (generally, your first exemption is $95000). Fines, fines, fees and interest will be accumulated in several years. It will soon merge into an incomprehensible sum. Personal asset liens, account withholding, and payroll withholding are all punitive measures that the IRS can take.

Another important consideration is how much time and emotional effort it takes to submit matters to the IRS. It may take several years. In addition, passports may be cancelled or refused to renew. This puts a person in an almost impossible position. Moreover, it is difficult to correct this situation until one’s taxes are settled. Other factors that make your life derail as usual are the inheritance you can obtain, the eligibility of social security, or the settlement of financial problems after divorce. There is no statute of limitations. In the United States, the legal term is 10 years. But once you leave America, your watch will stop and wait patiently for you to come back.

It’s easy to do – you can do the same.

The prospect of US tax filings looks daunting, but in order to help and scrutinize all the documents and records that need to be submitted, hiring a certified public accountant is even worse. In fact, this process is much simpler than most foreigners imagine. Once you start, the whole effort can be easily completed in a few weeks. Now that there is a clear and safe road, the IRS itself has banned it. Then, the appropriate solution is to let it be taken care of. Then enjoy the peace of mind brought by the “full beast”!