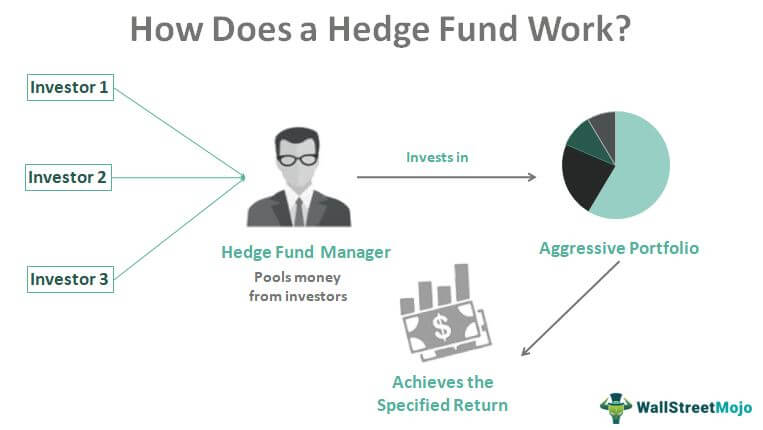

If you do not represent a company annuity fund or a very wealthy individual, you are not eligible to participate in hedge funds, and there is no need to choose a hedge fund accountant. However, if you want to know how the company’s pension fund operates, you will be interested in understanding how hedge funds operate. A hedge fund manager controls an account or fund that actively trades for a group of individuals. Investors who want to participate in the Fund buy shares of the Fund. Generally speaking, hedge fund managers also buy stocks and participate in their own funds. This connects his wealth with that of his customers.

Hedge funds are treated differently from other funds. For example, the design of mutual funds is stable and the rate of return on investment is stable and appropriate. Both hedge funds and mutual funds are open. This means that when you participate, you can withdraw or deposit funds at any time. The principal of mutual funds is increased by investing in reliable and growing companies such as public utilities. It only buys stocks, not shorting. More active mutual funds may aim at higher growth companies, such as the technology industry, to obtain higher returns, but the risks are greater. In a recession, mutual funds always lose money. Due to the economic downturn of the past 10 years, mutual fund based retirement accounts have been seriously hit.

In contrast, hedge funds operate in a very different way. Hedge funds can not only buy stocks freely, but also short stocks in the case of economic downturn. This means that positive ROI can be achieved regardless of the economic environment. But higher returns are always constrained by the financial fundamentals at the cost of greater risk. The bigger risk for hedge funds comes from short selling. When investors buy more than one stock, their losses will never exceed their financial investment. But if investors fall into short selling, they will lose more money than they invest, and they will actually get debt. It is much more difficult to control this risk and accurately predict economic growth and recession than to simply choose high growth companies. This is why it is important to review the qualifications of hedge fund accountants.

Leverage is another strategy used by hedge fund managers. Leverage means that you only buy certain stocks as part of their actual value. When purchasing with this method, the stockbroker will make up the difference. In exchange, he predicts that the stock price will not change enough to endanger his participation. The leverage ratio is the ratio of stock value to investment amount. The leverage ratio was 2:1, and the stock increased by 1%, generating 2% investment income. Hedge fund experts can use leverage ratio of 10:1 or above. This means that real benefits are possible. This also means a real risk of huge losses.

Two are hedge fund accountants used to identify investors’ success. This is the long-term investment yield and withdrawal. The minimum time frame is usually 20 years. During this period, the ROI can be checked from beginning to end. This is the current rate of return on investments and holdings 20 years ago. It is also wise to observe the negative deviation of the straight line of economic growth. This deviation is called extraction. The withdrawal of more than 20% means that there is considerable risk in the account.

Only by doing more research can people fully understand hedge funds. Nevertheless, this information will help to understand the basic operations of hedge funds.