Your first few paychecks may mean the world to you, but more important than simply counting your money is managing its use effectively. Especially if you are comfortable with your parents managing most of your finances so far! Obviously, things were a little difficult to deal with at the beginning. Monthly bills and strange responsibilities, such as spending every penny you earn when paying taxes, weaken your happiness. In this case, as a novice, there is a guide to managing finance.

Monthly cost management

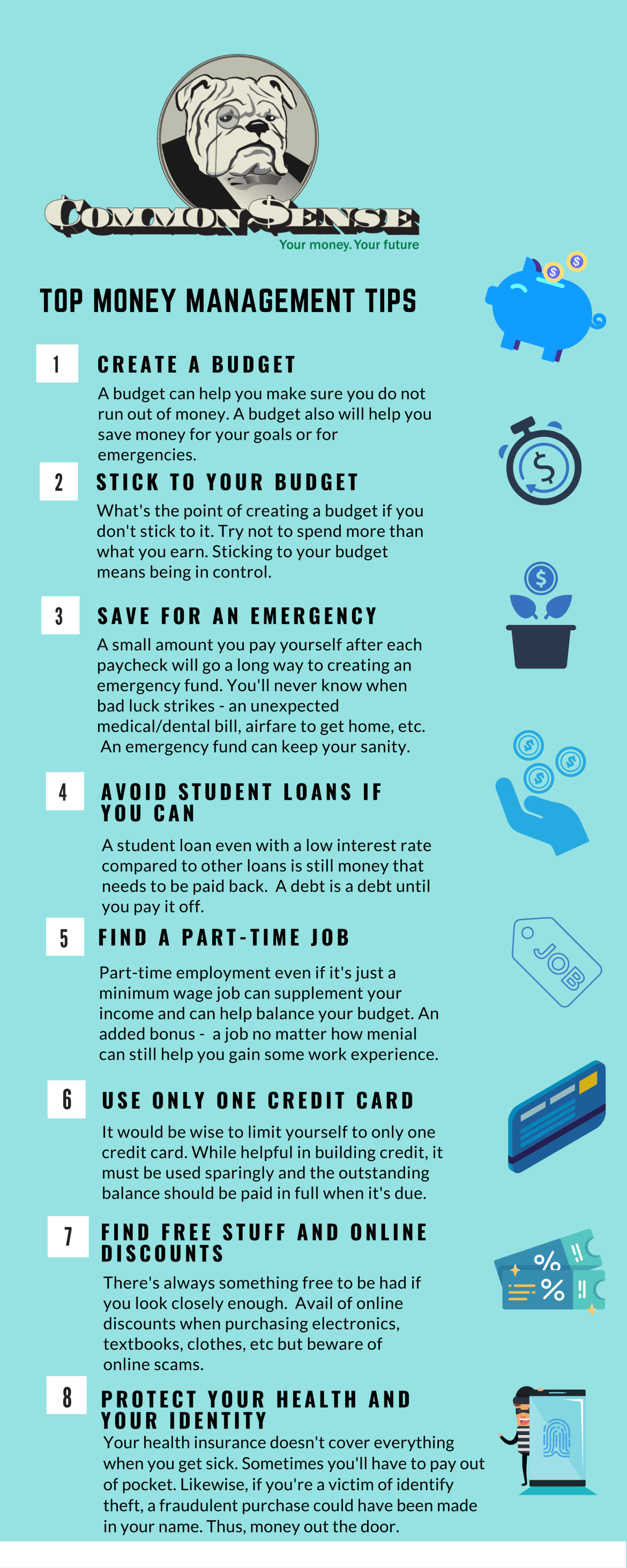

Although you may need time to painfully monitor your financial situation to ensure that your monthly expenses do not exceed the limit, you must do what you need to do. Make sure that you pay all your bills before the end of each month, and do not pile them up beside your bed. You will pay extra later. Check the money you spend on groceries and the number of days you eat out in a month. At least until I know where you can spend your money.

pay taxes

This may make you want to flinch, but once you start making money for yourself, you should regularly and diligently complete relevant paperwork. This is part of many responsibilities. You have a clear forecast of the taxes you will pay, which will help you manage your expenses from the beginning and even help you benefit from tax savings.

Insure yourself

When your parents annoy you with many contact information of insurance companies, they do not want to nag you, which is very important. The faster you handle things, the better. Invest in your income and register in an insurance plan. This may be a health insurance plan, or a plan to insure your house or car, to avoid any recent or recent mishaps.

bank deposit

Once you think you have completed the settlement and personal consumption, it is strongly recommended that you go to the nearest bank and quickly deposit your money into a savings account or fixed deposit account to ensure that you can make a large profit from the interest earned in a few years.

Enjoy!

Well, you don’t work every day to save money and live a miserable life, do you? A small gift for yourself! It’s fair to take a shopping trip (monitoring), give yourself a SPA, or occasionally go to other places to eat every month. Just to keep you going!

Nevertheless, with a little care, prevention and planning, you can effectively manage your finances and ensure that you will never be in debt, at least not immediately after becoming a part of the working class!